20+ questions to ask yourself before fundraising

And how to raise money and build strategic partnerships with top athletes and investors - The story of Recharge.Health

It took them 9 months to raise money and build strategic partnerships with investors and top athletes, such as Casper Ruud 🏆. In the fundraising world, that´s fast.

Recharge.health made nearly EUR 3M last year. They have a strong team in place, worldwide sales, and it took them 9 months to close their EUR 500K round.

After testing different fundraising strategies, knocking on several doors, and arming themselves with patience, they finally reached their goal.

This week, I interviewed their CCO to share their story, process, and strategies. Find the link at the end of the article.

Before that.

Yesterday, I gave a lecture on fundraising best practices at OsloMet, a university in Oslo. Advising entrepreneurs = my favorite thing.

Among other things, I shared 20+ questions founders should consider before and during fundraising.

Here are the questions. Let´s go 🚀

20+ questions to ask yourself before & while fundraising

1. Do I really need to raise money?

Yep, that´s number 1.

Shark Tank, Demo Days, Pitch competitions, and startup magazines have glamorized fundraising.

But fundraising is time-consuming, heavy, nerve-racking, and not always necessary.

In retrospect, many realize that making money would have been more beneficial, than raising money.

Read here a Linkedin post I wrote on this topic.

2. How much funding do I need? What will the funds be used for?

Maybe you need less than you think. Or maybe you need more. Have you done your financial projection? Do you have an overview of your different costs and revenue streams?

Are you certain that you need money to build your platform? Could you start with no-code solutions? Perhaps you are raising money to gain traction, PR, and build a community. Do you really need funding to achieve that? Or are you raising money to pay yourself a salary?

Professional early-stage investors don´t generally like to invest to pay salaries or to build a tech… unless you have validation, LOIs, a waitlist of potential users, and a strong signal that the market is waiting for your solution.

Keep that in mind and have your answers ready.

3. What is our runway? How many months your business can operate before it's out of money?

Don't start fundraising when you only have 6-9 months left. Plan ahead. Reaching out to investors when you are soon short on cash will be perceived as bad management and a red flag.

4. What will I be able to achieve with this amount?

What are the key milestones the amount will help you achieve? When will the next fundraising round happen and why? What´s next for you?

5. Can I do it without external capital?

FREEDOM IS PRICELESS.

Bootstrap if you can. This is especially true at the start of your business. It is better to be free, on your own, and take your time to find the right people for your venture.

6. How can I do it without investors?

Can you work on the side? Can you increase your prices? Can you sell more? Can you reduce your costs?

I would recommend a combination of these. That´s how I do it.

Look at public grants. Consider taking a bank loan.

7. Can my friends and family invest?

It is easier to start with your close network, people you know, who believe in you and trust you. Trust is at the core of fundraising. When you don´t have traction, PR, clients, users, online visibility etc. to give you more credibility, start with those who know you. Actually, always start with those who know you.

Maybe your ex-boss, your ex-colleagues, or your entrepreneurial friends.

There is a reason why at an early stage it is recommended to raise money from FFF (friends, family, and fans/fools😶).

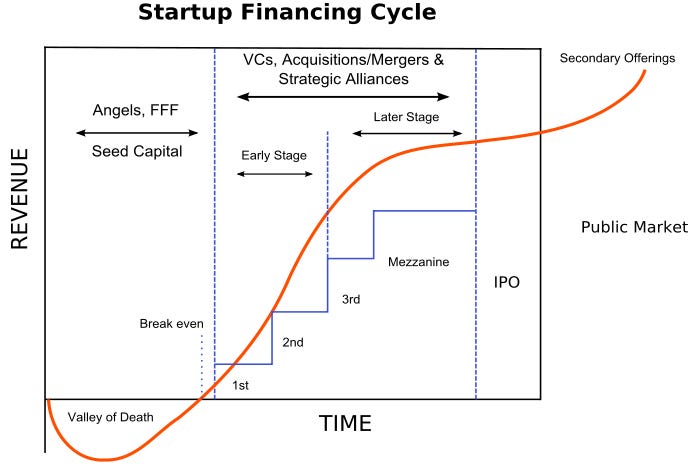

Start with them, then approach angel investors. VCs come much later as you can see.

8. Who are the potential angels within my network?

Make a list and look at their profile. Are they active investors? Have they invested in a similar company recently? Is there anyone who can make a warm intro?

Do your research first. Check if they match your company´s stage, industry, business model, and if they are active.

It will save you time and your reputation.

9. What kind of investor matches our stage, industry, and business model?

Keep reading with a 7-day free trial

Subscribe to For CEOs & Leaders From Idea 🌱To EXIT 🦄 to keep reading this post and get 7 days of free access to the full post archives.